Differences sometimes resolve within minutes as blockchain data updates totally. Contract interplay reveals your pockets executing sensible contract functions like swaps or staking. The explorer decodes which perform you known as, enter parameters, and fuel charges paid for execution. Here’s how much tax you may be paying in your revenue from Bitcoin, Ethereum, and other cryptocurrencies. Be A Part Of 500,000 people immediately calculating their crypto taxes with CoinLedger.

Binance Smart Chain: Bscscan

Exchange-integrated products like Crypto.com and data-heavy tax instruments speak about certification frameworks and secure dealing with of financial data for good reason. Gas costs, yield farming rewards, re-staking, and liquidity provider publicity all change your true P&L. DeFi-aware trackers read protocol positions and assist avoid double-counting. For example, they will distinguish between LP tokens and the underlying assets, as an alternative of treating both as separate holdings.

Unsure What’s One Of The Best Crypto Tracker?

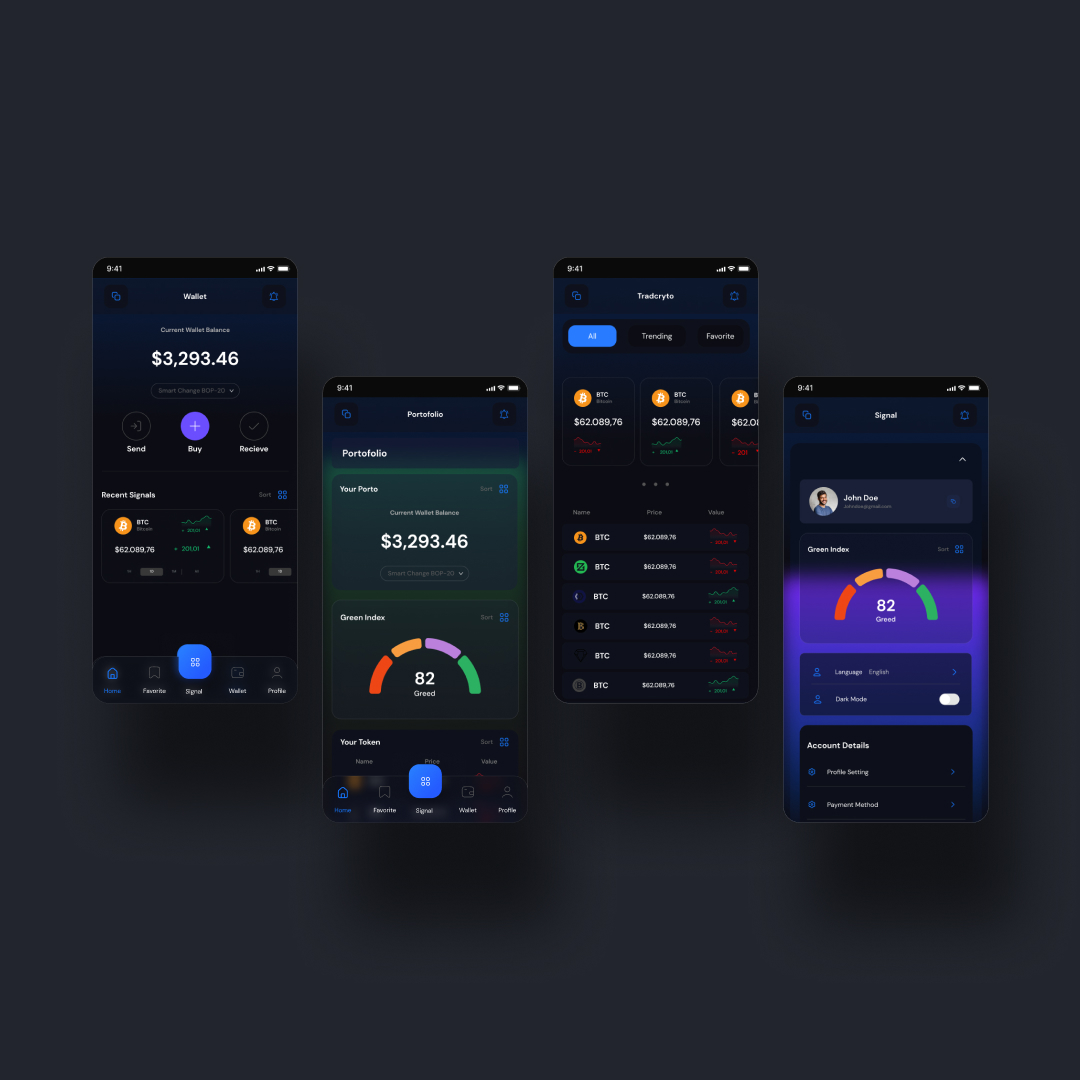

The app allows customers to sync their wallets and exchanges, making it handy for these with a quantity of property across numerous platforms. Additionally, it offers real-time alerts and price monitoring for hundreds of cryptocurrencies, allowing users to stay up to date. Many crypto portfolio trackers also come with further options like information alerts, price predictions, and danger analysis instruments. In addition to portfolio tracking, it additionally offers real-time cryptocurrency prices, market capitalization, buying and selling quantity, and different important information. It provides value monitoring for over 10,000 cryptocurrencies and exhibits information about 700+ digital exchanges worldwide.

The 10 Finest Crypto Portfolio Trackers

Data such because the variety of trades, common return on funding, average threat per commerce and revenue and loss can be recorded for each commerce. The overview part provides a abstract of the open and closed trades, which could be filtered by the buying and selling pairs and position measurement. One of the most effective options that Coinigy presents is the 30-day free trial. Customers can get a taste of charts, cryptocurrency indicators, and portfolio administration throughout this era. Unlike CoinStats, which costs a set charge to facilitate Pro companies, Coinigy uses a unique mannequin. It modifications the payment month-to-month depending on how long the user is dedicated to using the service.

- Many trackers include further features like price alerts, tax reports, and analytics, helping you see tendencies and make smarter funding strikes.

- The software program is appropriate with all well-liked DeFi protocols and mechanically imports NFT trades for EVM-based blockchains like ETH, Polygon, BSC, and Chronos.

- Tools with sturdy API help permit for automation of technique execution, information syncing, and compliance reporting across platforms.

- CoinStats is a robust portfolio tracker designed for traders who need real-time data and multi-asset help.

- A free account is on the market for managing as much as 200 trades, but upgrading is required to entry all features.

Crypto Portfolio Tracker: The Most Effective Solutions In 2025

A trusted helper ought to act on the user’s behalf and in the recipient’s greatest interest. You can select from plans like Pro, Expert, and Unlimited for added wants, with monthly charges starting at 12.99 USD. You can all the time change tracks later, but beginning with the proper class saves time. The goal is to not crown one winner right here, however to indicate the patterns.

Santiment is a number one behavioral analytics platform for crypto buyers, merchants, and builders. It turns uncooked blockchain, social, and market knowledge into actionable insights. With instruments built for everybody from hedge fund managers to NFT creators, Santiment simplifies advanced crypto analysis and divulges the story behind market conduct. Some crypto wallet trackers talked about on this article present tax reporting options that allow customers to import their transactions and calculate their gains.

Debank and Nansen are constructed around wallet-first, DeFi-heavy tracking, whereas a more generalist tool could solely show token balances without acknowledging advanced positions. On the DeFi facet, you want to know whether the tracker can read LP positions, staking deposits, lending positions, and yield farming methods. CoinStats and Nansen Portfolio show protocol names, token allocations, and yields across main platforms like Uniswap, Aave, Curve, Lido, and others. DeFi and NFTs add their own complexity, and lots of trackers treat them as first-class residents or as an afterthought. If you farm or stake on smaller or newer chains, integration counts begin to matter.

Others are non-custodial wallets, which suggests you manage your individual funds and routing. Multi-Party Computation (MPC) wallets break up a private key into encrypted elements and unfold them out throughout gadgets or individuals. Non-custodial wallets provide complete management, but https://www.sbnewsroom.com/crypto-wallets-for-brokers you’re by yourself if things go wrong. Go non-custodial—and again up your seed like your life is dependent upon it.