Economic Moat is an idea popularized by Warren Buffett to describe an organization’s sturdy aggressive advantage. It represents the ‘moat’ that protects an organization from opponents and helps it maintain profitability over the lengthy run. Our analysis of the previous 10 years confirmed that firms with a large economic moat considerably outperformed the market, delivering +645% returns in comparison with +189% for the S&P 500. Discounted Cash Circulate (DCF) valuation is a technique of estimating the present value of an organization based mostly on projected future money flows adjusted for the time value of cash. The earlier big move we wrote about was eleven days in the past when the stock dropped three.8% on the information that a broader market downturn was led by technology shares as investors engaged in profit-taking firstly of the model new yr.

- You ought to consult your legal, tax, or monetary advisors before making any monetary choices.

- Together With Debt Paydown Yield in the Shareholder Yield calculation gives buyers insight into the company’s dedication to reducing debt alongside returning worth by way of dividends and buybacks.

- Cryptocurrency.Cryptocurrency trading, execution and custody services are offered by Zero Hash LLC (“Zero Hash”).

- The experience of serving a client base with a 70/30 cut up between emerging and established companies has offered invaluable insights.

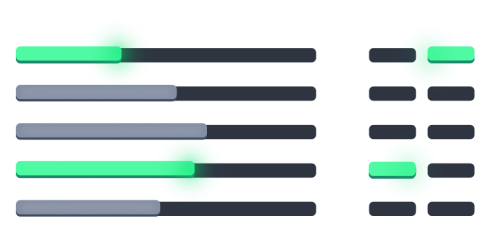

- After each calculation the program assigns a Buy, Promote or Maintain worth for the research, relying on the place the worth lies in reference to the common interpretation of the examine.

When Promoting Enters The World Of Ai: What Conversational Personalization Actually Adjustments For Brands

This distinctive velocity is a direct results of our distributed structure and optimized information flow, which minimizes latency and ensures execution precision, providing a dependable foundation for brokers and their end-users. At the center of this ecosystem is B2TRADER, a high-performance buying and selling system engineered to interact with today’s evolving, multi-asset markets. B2TRADER isn’t merely a platform for executing trades; it is a central nervous system designed for high-speed commerce execution and complete support for an enormous vary of asset classes. The sheer scale of this evolution is putting; the global online-trading-platform market reached around $10.9 billion in 2024 and is anticipated to exceed $14 billion by 2027, even with reasonable growth. As such, the normal approach to financial technology struggles to keep tempo with client and infrastructure demands.

Connect all your favourite business apps and automate tasks for a frictionless expertise. Turning insights into actionable strategies for better decision-making and increased sustainable gross sales growth. Copyright © 2026 FactSet Analysis Methods Inc.Copyright © 2026, American Bankers Association https://www.xcritical.com/.

What’s A Trading Crm And How Can It Benefit My Trading Business?

They want to have the flexibility to easily configure trading parameters, manage Introducing Broker (IB) fashions, customise interfaces, set dynamic risk limits, and define consumer roles with precision. In this report, we’ll stroll by way of key monetary market changes, how we, at B2BROKER, responded to those calls for by way of our state-of-the-art infrastructure, and what the long run holds for us and the whole industry. Financial institutions right now face fast market expansion, rising regulatory stress, and more and more complex consumer demands. As legacy techniques struggle to keep pace, the convergence of CRM, trading, and liquidity has turn into essential. It isn’t a coincidence that corporate executives appear to always purchase on the proper occasions.

This just isn’t an offer, solicitation of a proposal, or advice to purchase or sell securities or open a brokerage account in any jurisdiction the place Public Investing just isn’t registered. Apex Clearing Company, our clearing firm, has extra insurance protection in extra of the common SIPC limits. Looking forward, the means forward for trading and CRM infrastructure might be defined by its capability to integrate rising applied sciences Volatility (finance), navigate regulatory complexities, and cater to an increasingly sophisticated institutional consumer base.

Faqs About Salesforce (crm) Pre-market

A key driver of this success is the seamless user experience, with over 70% of customers accessing the system through cell gadgets, highlighting the platform’s adaptability to modern buying and selling habits. Where market worth tells you the worth other individuals are keen to pay, truthful worth shows the value of a stock based on an evaluation of the company’s precise financials (such as money stability, revenue, working margin, etc). This metric is crucial for calculating Shareholder Yield as it immediately displays the company’s efforts to return value to shareholders. By reducing the variety of shares, buybacks can improve earnings per share and doubtlessly increase the inventory’s worth.

As the industry reaches a critical inflection level, the convergence of CRM, buying and selling, and liquidity not represents a strategic aim but acts as an operational push. The experience of serving a client base with a 70/30 split between emerging and established companies has offered invaluable insights. The first, and arguably most crucial, measure of efficiency is pace as a result of in a fast-paced world of monetary markets, each millisecond counts. As a end result, B2BROKER’s API-first architecture ensures a high diploma of flexibility and readiness for regulatory compliance. The intensive API documentation supports the seamless integration with external techniques, whereas a complete suite of native options addresses the most urgent regulatory wants. The convergence of those once-separate functions is not trading crm platform a pattern; it is the essential subsequent step within the evolution of monetary companies, and one we’re proud to be main.

Equally essential are the operational metrics that reflect consumer onboarding velocity and retention. On common, new purchasers go reside within just ten working days — a benchmark that underscores the maturity of our turnkey structure. Meanwhile, the churn rate remains exceptionally low, highlighting long-term platform stickiness and sustained satisfaction throughout our ecosystem. This eliminates the need for merchants to manage separate accounts for each asset kind and ensures a seamless buying and selling experience from one account, a key benefit in a market that demands versatility. At its core is a smart order routing system with A/B/C execution that mechanically directs orders to one of the best available markets, making certain optimum execution.

Automating approval processes and integrating with monetary databases allows quicker and extra informed decision-making, thus lowering monetary and operational risks. The B2CORE CRM handles all client-facing operations, including onboarding, KYC, and payment processing, and is pre-integrated with the B2TRADER and the Liquidity gateway. This setup eliminates weeks or months of growth time and allows Shopper A to go live with a fully practical, multi-asset & multi-market trading platform. This high volume, combined with a outstanding YoY consumer base growth of 124%, demonstrates robust market demand and a excessive level of end-user engagement.

Our architecture is a deliberately unified ecosystem designed to address core trade challenges—not just by providing superior instruments, but by making certain those instruments work collectively seamlessly. While many off-the-shelf solutions supply a few of these features, they typically fall short of the required customization. Conversely, custom-built methods may be prohibitively costly for a commercial product. This is where a really unified answer, developed by a robust group with a vision for an built-in ecosystem, presents the best of each worlds. A widespread setup involves a separate client-facing portal, an exterior CRM resolution, a third-party trading platform, and a totally unbiased KYC system. Our analysis into Financial Moat efficiency spans the previous 10 years and focuses on firms with a large financial moat.